Company codes and company code groups within FI-CA

By Marius Tack, SAP BRIM consultant

Understand how postings in FI-CA are linked with the organizational structure of your company.

In this article, we will try to deepen your understanding about the usage of organizational units within FI-CA.

Internal and external reporting is one of the major requirements your organization needs to fulfil, in consequence, you need to reflect the real-life organizational structure of your company in SAP.

The basics

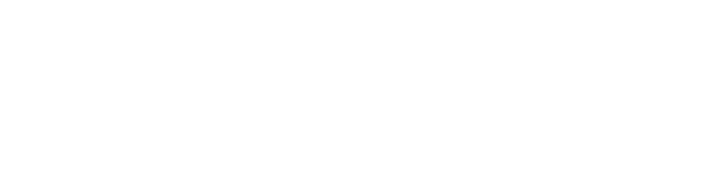

With the two objects company and company code you model your fiscal and operative organization in SAP. The Company Code being the lowest level you can produce a full tax report for. Company allows you to easily do financial consolidations to a holding level. The sample below shows a holding which is used as a bracket over the UK and US subsidiary.

Before you create the structure by using the given templates (!!), align it with the relevant stakeholders.

Path to happiness:IMG -> Enterprise Structure -> Definition -> Financial Accounting

Company code in FI-CA

As you all know the FI-CA document consists of a header and items for the business partner and the general ledger side as well. The company code is not stored on the level of the document header, but on the level of the business partner items.

In order to enable a company code to be used in FI-CA some settings are needed, you find the IMG activity here:

FICAIMG -> Organizational units -> Setup Company Code for Contract Accounts Receivable and Payable

In preparation of this activity you should try to clarify the following questions within your project:

Company code groups

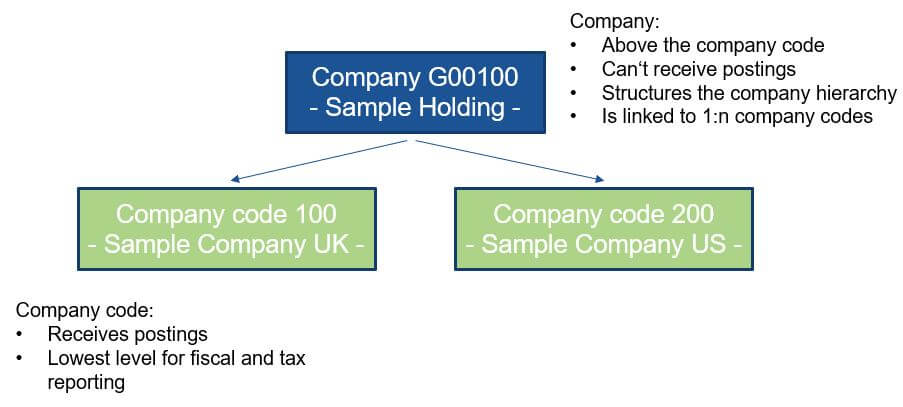

After the definition of the company codes we need to prepare the company code groups. The company code group is the object, which controls which company codes are eligible for posting on a contract account object.

According to our sample holding above we can imagine three company code groups:

- Group H100 – postings on company codes 100 and 200 allowed.

- Group 100 – only postings on company code 100 allowed.

- Group 200 – only postings on company code 200 allowed.

For each company code group you assign exactly one paying company code, which is used for payments across all company codes within the group. This creates an implicit connection to the contract account.

The needed customizing nodes are here:

FICAIMG -> Organizational units -> Setup Company Code for Contract Accounts Receivable and Payable -> Define Company Code Groups

FICAIMG -> Organizational units -> Setup Company Code for Contract Accounts Receivable and Payable -> Assign Company Codes to Company Code Groups